In the intricate world of investing, understanding the dynamics of growth is paramount. The Rule of 70, a deceptively simple yet powerful tool, serves as a beacon for investors seeking to estimate the time it takes for their investments to double. In this detailed blog post, we will delve into the depths of the Rule of 70, exploring its formula, practical applications, and real-world examples to empower investors with a deeper understanding of its significance.

The Essence of the Rule of 70

The Rule of 70 is an exponential growth formula designed to estimate the number of years it takes for an investment or economic variable to double, based on a fixed annual rate of return or growth. It’s a valuable tool for investors looking to gain quick insights into the potential trajectory of their investments without delving into complex calculations.

The Formula: A Deeper Dive

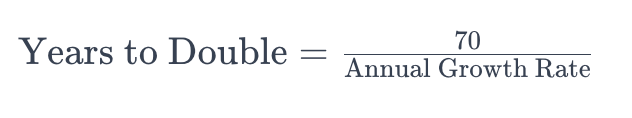

The Rule of 70 formula is elegantly simple but rich in implications:

This formula allows investors to assess the doubling time of an investment by dividing 70 by the annual growth rate. The resulting number represents the estimated number of years it will take for the investment to double at the given growth rate.

Applying the Rule of 70: Real-World Examples

Example 1: Stock Investment

Let’s say you have a stock investment with a consistent annual growth rate of 8%. Applying the Rule of 70:

This means that, with a fixed annual growth rate of 8%, it would take approximately 8.75 years for your stock investment to double.

Example 2: Retirement Portfolio

Consider a retirement portfolio experiencing an annual growth rate of 6%. Using the Rule of 70:

In this case, with a consistent annual growth rate of 6%, the retirement portfolio would take approximately 11.67 years to double.

Significance of the Rule of 70 in Investing

- Exponential Growth Insight: The Rule of 70 highlights the exponential nature of compound growth, emphasizing that as an investment grows, the rate of its growth also accelerates.

- Quick Investment Assessment: Investors can use this rule for rapid assessments, providing a ballpark figure without the need for complex calculations. It serves as a valuable tool for setting initial expectations.

- Strategic Planning: The Rule of 70 aids investors in setting realistic timeframes for their financial goals. Whether planning for retirement or evaluating the potential of a long-term investment, this rule contributes to strategic decision-making.

Limitations and Considerations

- Assumption of Constant Growth: The rule assumes a constant annual growth rate, which may not always align with the real-world variability of investments. Actual returns may fluctuate.

- Applicability to Moderate Growth Rates: The Rule of 70 is most accurate for moderate growth rates. Extremely high or low growth rates may result in less accurate estimates.

Conclusion

The Rule of 70 emerges as a valuable ally for investors navigating the complexities of the financial landscape. By offering a quick and insightful estimate of the doubling time for investments, this rule empowers investors to make informed decisions, set realistic expectations, and strategically plan for their financial future. As you embark on your investment journey, let the Rule of 70 be your guide, unraveling the potential of your investments in the dynamic world of finance.

Leave a Reply